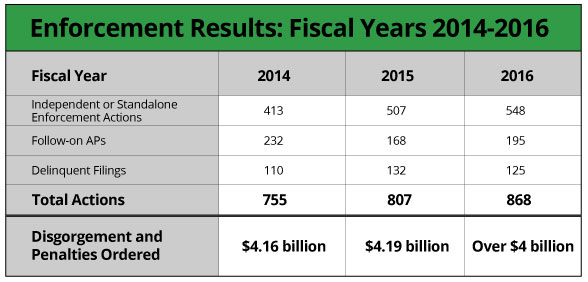

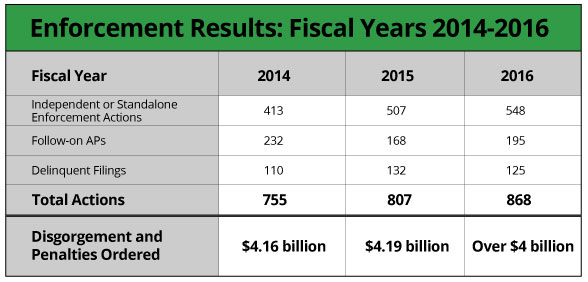

On October 11, 2016, the Securities and Exchange Commission (“SEC” or “Commission”) announced its enforcement results for its 2016 fiscal year. The SEC brought an all-time record 868 enforcement actions in FY 2016, the third consecutive year in which the SEC has set a new record for enforcement activity. The 868 enforcement actions were an approximately 7.5 percent increase over 2015 and nearly 15 percent over 2014, and resulted in the Commission collecting over $4 billion in disgorgement and penalties in FY 2016.

SEC Chair Mary Jo White attributed part of the enforcement increase to the Commission’s new data analytics systems, which she said enables the SEC to uncover fraud, litigate tough cases, and expand its enforcement “playbook” in novel enforcement actions. For example, she has touted these systems’ ability to help the SEC to spot suspicious trading patterns, which likely played a role in many of the 78 insider trading actions the Commission brought in FY 2016. Chair White also touted the contributions of the SEC’s whistleblower program, which continued to grow in FY 2016. The SEC awarded $57 million to thirteen whistleblowers in FY 2016, which is more money than the program had distributed in all of its prior years combined, and it received an ever-increasing number of tips.

Less evident, however, is the impact of the SEC’s continued “broken windows” approach to any given enforcement action. For example, while the SEC brought a record number of enforcement actions against investment advisors or investment companies during FY 2016, and a substantial number of these actions were surely the result of increased SEC resources and enforcement focus, some were seemingly the result of a greater willingness to bring enforcement actions for technical violations in the absence of scienter, and many resulted from the increasing coordination with examinations conducted by the SEC’s Office of Compliance Inspections and Examinations. Accordingly, while the latest SEC enforcement statistics are a reminder that the SEC is as aggressive as ever, they shed limited light on how the SEC will act in any given case.